Housing Now 2025 Definitions

This document is a concise glossary for “Housing Now 2025” that standardizes key terms used in housing and homelessness systems. It defines concepts like Affordable Housing, At/Imminent Risk and Literal Homelessness, Housing First, Rapid Re-Housing, Permanent Supportive Housing, Progressive Engagement, and related supportive services and case management roles. Practically, it’s meant to align programs, eligibility, and service delivery by giving shared definitions for partners and providers.

Report Title: Unlocking Housing Relationships: Bridging Tenants, Community Based Organizations, and Property Managers Through Coalition

Report Author: Tara Rollins

Description: As the demand for affordable housing continues to grow, this report emphasizes the importance of addressing the operational and systemic deficiencies in housing. Drawing on the Utah Housing Coalition’s analysis, it amplifies the voices of tenants, PMs, and CBOs to provide actionable recommendations that reflect community needs. The ultimate objective is to cultivate trust, strengthen collaboration, and build impactful partnerships that drive equitable housing solutions for all. To achieve this, we propose the formation of a Landlord and Community Partners Coalition (LCPC)—a unified platform dedicated to bridging gaps, fostering innovation, and delivering transformative housing outcomes through education and resources.

Wasatch Back Affordable Housing Economic Impact Analysis

Prepared for: Mountain Lands Community Housing

Trust Prepared by: Economic & Planning Systems, Inc. August 9, 2024

The purpose of this report is to illuminate the interdependency of economic vitality and community vibrancy and document how the ability to leverage the economic drivers represented by visitation is dependent on the availability and affordability of housing for the local workforce. In this analysis, these interconnected elements are presented collectively, discussed in terms of community benefits, economic value, and opportunity costs. This approach quantifies the economic benefit of resident housing in the Wasatch Back, highlighting the importance in sustaining both the local economy and community vibrancy amidst continued rapid growth and change.

Ari Bruening

Envision Utah, CEO

The game of musical chairs is an apt analogy to a region's housing supply. In musical chairs, there's always one fewer chair than participants, leaving someone without a seat. If the rules are tweaked, maybe the loser shares a chair with someone else. Or consider what would happen if everyone were to bid money for the right to a chair—wouldn’t the price of each chair be far higher than if there were an available chair for everyone? This analogy mirrors the housing market’s dynamics when there’s a scarcity of housing: some are left without homes, or are forced to share homes with others (maybe grown children sharing with parents), and the price of homes rises for everyone.

If Utah doesn’t take aggressive action to address the issue, our younger Utahns will struggle to enjoy the same opportunities as prior generations, affecting not only

their quality of life but upward mobility and family sizes. This crisis holds far-reaching implications that impact Utahns across various age groups and walks of life.

Click here to read the full report

Preserving Affordable Senior Housing Matters

Within the next 25 years, Utah could lose over 40% of its federally subsidized rental units for low-income seniors. More than 15% of the units could be lost by 2030. Without this vital source of low-income housing, more than three thousand senior households could experience housing instability and homelessness in the coming decades.

This report recommends several steps to eliminate these barriers and make senior housing preservation a statewide priority. These recommendations include:

1) Incorporate senior housing preservation, specifically a roadmap for expiring units, in moderate-income housing plans

2) Establish a dedicated source of funding for senior housing preservation

3) Adopt age-friendly zoning codes

4) Implement a one-year notification requirement for expiring subsidized units

The report begins by analyzing the risk of subsidized senior housing expiration in Utah. The first section details the characteristics of the state’s subsidized senior housing stock and outlines the hampering effect subsidy expiration will have on affordable senior housing production. This section also deals specifically with the threat the statewide affordable housing crisis poses to LIHTC-funded senior housing units. The second section discusses the outcome of subsidy expiration for low-income seniors who lose their subsidized housing due to market-rate conversion. The third section provides context to understand the nuances of the affordable senior housing crisis and the financial circumstances of low-income seniors that contribute to these nuances. The fourth section identifies barriers to senior housing preservation and offers policy recommendations to overcome these challenges.

-

This interactive map shows the dwindling supply of affordable senior housing

Timeline of Redlining & Zoning in the United States

In the 1930s, the government-sponsored Home Owners' Loan Corporation (HOLC) created color-coded maps of cities across the U.S. These maps colored the "safest" neighborhoods ◼︎Green and the "riskiest" neighborhoods ◼︎Red. In a practice known as redlining, neighborhoods earned a red color if black residents lived in them. The Federal Home Loan Bank Board used these maps to deny lending and investment opportunities to black Americans. Read the Report.

Out of Reach Report 2024

For more than 35 years, the National Low Income Housing Coalition’s (NLIHC) Out of Reach report has called attention to the disparity between wages and the cost of rental housing in the U.S. Every year the report has shown that affordable rental homes are out of reach for millions of low-wage workers, seniors, families, and other renters. The report’s central statistic, the Housing Wage, is an estimate of the hourly wage a full-time worker must earn to afford a modest rental home at HUD’s fair market rent (FMR) without spending more than 30% of their income on housing costs – the accepted standard of affordability. The FMR is an estimate of what a family moving today can expect to pay for a modestly priced rental home in a given area. Continue to read the report

Utah's Profile

Utah Bar Foundation Report on Debt Collection and Utah's Courts

Utah is one of the few states working to gather data on and address issues related to debt collection cases in its courts. A new analysis by the Utah Bar Foundation (UBF), conducted with support from Pew, uses state-collected court data on tens of thousands of credit card, medical, rent, and other debt-related cases to assess civil court processes and recommend improvements.

The data shows that from 2013 through 2020, Utah courts issued more than 385,000 judgments, totaling nearly $2 billion, in debt cases, but as of this writing, fewer than half of those have been paid in full. In evictions, 82% of judgments from cases filed from 2013 to 2020 remained similarly unsatisfied as of December 2021.

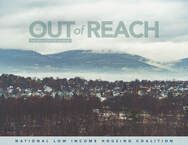

The Gap: A Shortage of Affordable Home

2024 The GAP Now Available!

Each year, the National Low Income Housing Coalition (NLIHC) measures the availability of rental housing affordable to extremely low-income households and other income groups. Based on the American Community Survey Public Use Microdata Sample (ACS PUMS), The Gap presents data on the affordable housing supply and housing cost burdens at the national, state, and metropolitan levels. The report also examines the demographics, disability and work status, and other characteristics of the extremely low-income households most impacted by the national shortage of affordable and available rental homes.

PAVE report examines racial bias in the appraisal process

HUD announced on Wednesday the publication of the highly anticipated Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) report. The task force, announced in a June 2021 executive order from President Biden, is co-chaired by HUD Secretary Marcia Fudge and White House domestic policy advisor Susan Rice. It was created to evaluate the causes, extent, and consequences of appraisal bias in homeownership. It ultimately seeks to counter historic disinvestment and undervaluation of minority homes and takes steps to create a more equitable system. The report discusses the history of appraisal bias and its impact on homeowners today, and makes several broad recommendations that PAVE says will help fight discrimination.

2021 Picture of Preservation

The United States faces a shortage of nearly seven million rental homes affordable and available to the lowest income households. As a result, 70% of extremely low-income renters whose household income is below the poverty threshold or 30% of their area median income (AMI) are severely cost-burdened, paying more than half of their income on rent and utilities (NLIHC, 2021). Meanwhile, federal housing subsidies provide a vital, albeit insufficient, supply of housing affordable to the lowest income renters, while state and local subsidy programs fail to adequately fill the gap. How to address this shortage of affordable housing, while managing and protecting the existing stock is a critical question for affordable housing policy. Read the Full Report Interactive Maps of Expiring U.S. Properties

Picture of Preservation Report State Comparison Tool

Picture of Preservation Property Search Tool

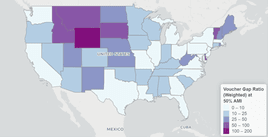

Exploring a Universal Housing Voucher - An Interactive Report

The Housing Choice Voucher (HCV) is a portable subsidy that households can use to rent a housing unit in the private market. The voucher covers the difference between 30% of the household's income and the full cost of rent (up to a maximum rent level set by the U.S. Department of Housing and Urban Development). This means that as household income fluctuates, so does the amount of the subsidy, ensuring that the household does not become housing cost burdened. Read the full report by The Housing Initiative at Penn.

The Opportunity Starts at Home multi-sector affordable homes campaign recently released a new issue brief, survey, and podcast on the connection between educational outcomes and housing. These new resources are now available on the campaign’s website and are aimed at deepening the understanding of advocates and policymakers about the connection between student achievement and housing stability.

The issue brief explores three channels in which housing influences educational attainment: 1) housing security and educational achievement; 2) housing mobility, school access, and integration; and 3) housing security and postsecondary access and success. Each section of the issue brief provides in-depth analysis of racial inequities present in each channel. The brief also contains an explanation of federal policies that would address these channels and explores successful state and local programs. The brief was developed in consultation with the campaign’s Racial Equity Working Group.

Utah Evictions & Connections to Racial Ethnic Disparities in Utah

Prior to this report, there was no data to assess how gender, race, and ethnicity are connected to evictions and eviction frequency in Utah. Although there is a public record to show the amount of evictions per county, names of evictees, and the judgment call of the case, court systems do not have the capacity to provide identifying information of who those evictees are, demographically speaking. Without accurate information of these evictions, BIPOC communities are once again being underrepresented. This is a major disservice, not only to the individuals who are facing a disproportionate rate of eviction in these areas, but also to the resources and programs who aim to provide rental relief and support. If there isn’t accurate data when creating and implementing these programs, how will our communities accurately receive the support and resources they need? How will local governments efficiently create policies that address these problems? Read the full report

State of Rental Housing in Salt Lake County during COVID-19

In conjunction with Salt Lake County, Utah Housing Coalition (UHC) has worked to better understand the impact that the COVID-19 pandemic has had on housing needs and how the city, county, state and federal funds were used to keep people housed in a time of illness and economic hardship. Additionally, an exploration of the financial toll that eviction proceedings will have on families during the pandemic was done, and finally, a brief analysis of the cost burden of eviction to the county and the state in the form of emergency shelter, health care, emergency services and other state-funded resources for unhoused individuals and families was conducted. Read the full report

The Impact of High-Density Apartments on Surrounding Single-Family Home Values in Suburban Salt Lake County

This study found apartments built between 2010 and 2018 have not reduced single-family home values in suburban Salt Lake County. In response to accelerating housing prices over the last decade, the market continues to shift to denser development to slow this trend. However, denser development continues to be a politically controversial topic on city council agendas as existing residents often bring up negative impacts on home values. Single-family homes located within 1/2 mile of a newly constructed apartment building experienced higher overall price appreciation than those homes farther away. Read the report

COVID-19 Emergency Rental Assistance: Analysis of a National Survey of Programs

While estimates of the exact amount vary, studies agree that American renters now owe tens of billions of dollars in back rent, while many others have exhausted their savings, borrowed from family or friends, or used credit cards to keep up.1 The Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted in March 2020, provided two main funding streams that states and local jurisdictions could use for emergency rental assistance during these unprecedented times: Coronavirus Relief Funds (CRF) and Community Development Block Grants (CDBG-CV). As of midOctober, 44 states (including Washington, D.C.) and 310 local jurisdictions chose to devote roughly $3.9 billion to emergency rental assistance, which falls significantly short of most estimates of COVID-19- related needs. Read the report

State of Utah Annual Report on Homelessness 2020

The year 2020 brought Utah and the rest of the nation an unprecedented and unforeseen new set of challenges. The COVID-19 pandemic is impacting every aspect of life for every individual, business, service provider and governmental organization. Congress largely worked to address the impacts of the pandemic through the CARES Act, which included funds desperately needed for homeless services. The use of those funds is not reflected in this document, as the data reported here concludes with the Point-in Time Count in January 2020. Next year’s annual report will include data related to the pandemic and the CARES Act. Read the Report

State of Utah: 2020 Affordable Housing Report

Affordable housing is essential for healthy, sustainable communities. Nevertheless, issues concerning housing affordability are affected by a wide range of circumstances beyond real estate prices, such as zoning policies, economic growth, wages, utility costs and more. Providing governmental support to create an atmosphere where socially equitable forms of shelter are accessible is a challenge, but not an insurmountable one. Ignoring housing affordability, especially from an institutional point of view, will contribute to the slippery slope vulnerable Utahns continually risk, toward housing instability, homelessness and social detachment. Read the Report

Housing Affordability: What Are Best Practices and Why Are They Important?

Utah’s housing shortage and escalating prices reflect local housing policies. To be sure, market conditions—land, labor, and material costs—affect housing production and prices, but these factors offer scant opportunity for policy intervention. The best chance to shrink the shortage and improve affordability depends on local policies and practices. This study identifies five best practices developed by local jurisdictions to improve housing affordability. They include practices targeted at redevelopment agencies (RDAs), transit-oriented developments (TODs), accessory dwelling units (ADUs), preservation of existing affordable units, and changes in land use. Read the report

Utah Homeless Services: Governance Structure and Funding Model

The Kem C. Gardner Policy Institute prepared this assessment of Utah’s homeless services governance structure and funding at the request of the Utah Legislature and the philanthropic community. This assessment involved a collaborative review process of the structure and funding model in Utah. We offer six recommendations that will create a simpler, more transparent, and coordinated system for homeless services that will be more effective, efficient, and will improve alignment between public and private efforts. Read the report

Housing is Healthcare

The COVID-19 pandemic clearly demonstrates that housing is healthcare and underscores the critical need for people experiencing homelessness to be stably housed to stay well and to stop the spread of the virus. To address the health and housing needs of people experiencing homelessness, Congress provided critical resources in the “Coronavirus Aid, Relief, and Economic Security (CARES) Act,” including billions of dollars for FEMA’s Disaster Relief Fund. As the pandemic spread, first prompting President Trump’s National Emergency Declaration and now Major Disaster Declarations for all 50 states, the District of Columbia, and four territories, FEMA has taken on a larger role in COVID-19 response. FEMA determined that certain non-congregate sheltering costs will be reimbursable under the Public Assistance (PA) program, allowing state and local officials to request reimbursement for moving people experiencing homelessness to non-congregate settings where they can safely isolate or quarantine. Read the full report

Housing inequalities: Eviction patterns in Salt Lake County, Utah

Housing insecurity affects millions of Americans. Many cases in which individuals or families lack secure housing are the result of involuntary residential displacement, which often comes in the form of eviction and eviction threat from rental residences. This study takes a spatial analysis approach to understand patterns of evictions filed in Salt Lake County, Utah at the block group level. Modeling the geography of housing security attributes in urban areas is key to identifying inequality issues in potentially segregated regions. Two regression models are constructed that provide insight into inequalities based on race/ethnicity and socioeconomic vulnerability. The models show that there are clear inequalities in Salt Lake County, whereby those living in block groups of minority populations are affected by eviction at a substantially higher rate than those living in majority White population block groups. There is also a higher likelihood of threat of eviction if residents are already economically stressed. The implications of these findings are not limited to individual or family suffering, but also have negative community and larger social effects. Potential pathways to alleviating these issues are discussed in the conclusions section.

Affordable Housing Strategies - State of the Practice in 10 Utah Cities

The need for housing that is affordable has been steadily growing over the past several decades. Compared to the 1960s when relatively few households devoted over 30 percent of income for housing, about 37 million households in 2017 spent more than 30 percent and 18 million spent over 50 percent. Current regulatory restrictions—such as parking requirements, height restrictions, density limits, lengthy permitting processes, not in my back-yard opposition, for instance—have become major barriers to developing affordable housing. In addition, condominium conversion and gentrification reduces the supply of entry level housing for homeowners and multifamily rental housing—especially in growing urban areas. Moreover, the decline in production for first-time buyers and multifamily rental housing and tight affordable for sale and rental housing markets (i.e., low vacancy rates) are major contributors to the shortage of affordable housing. Read the full report

2020 Out of Reach Report

This year, the Out of Reach report is released during a time when the coronavirus has clearly illustrated that housing is healthcare. The mandate to “stay at home” was echoed by top officials across the country. However, having a stable place to stay was out of reach for millions of people before the pandemic. Prior to the pandemic, more than 7.7 million extremely low-income renters were spending more than half of their limited incomes on housing costs, sacrificing other necessities to do so. The compounding of high job losses and the lack of access to proper healthcare and resources considerably depleted already limited resources and access. Utah's profile

Emergency Rental Assistance Needs for Workers Struggling due to COVID-19

The COVID-19 outbreak and related shutdowns continue to have a devastating impact on the job market, and evidence suggests that lower-wage workers are the most likely to be suffering a loss of income. By some estimates, more than 13 million low-income renter households have already been affected. Before the crisis, many of these renters were already struggling: 18.7 million low-income renters were housing cost-burdened, spending more than they can afford for their housing, including 7.7 million extremely low-income renters who spent more than half their incomes on housing. While federal rental assistance reached only a fourth of eligible low-income renters before the pandemic, coronavirus-caused layoffs and pay reductions greatly exacerbate the need for such assistance. Read the full research note

Utah Affordable Housing Report 2019

This report examines the affordability of housing for various segments of the state’s population and considers the interrelated social forces, demographics and public policies that affect housing accessibility. It includes an analysis of Utah’s gap in affordable housing for households with moderate incomes. Specifically, it considers the availability of affordable rental units for three categories of renter households whose income are below the area median income. Rising housing costs and stagnating real wages are the primary causes of worsening housing affordability in Utah. From 2009 to 2016 real income only grew at 0.31% per year while rent crept upward at a rate of 1.03% per year in 2017 constant dollars. Now, more than 183,000 low-income Utah households pay more than half their income for rent, becoming more likely to be evicted and moving closer to homelessness. Read the report

Olene Walker Housing Loan Fund - 2019 Report

Program Year 2018-2019

The State of Utah Strategic Plan on Homelessness

Communities across Utah share one common goal: to end homelessness. To get there, we must work together to develop strategies, invest resources, and invite partners from across sectors to contribute toward this goal. We also need to ensure that the system of services is coordinated and adequately funded to effectively support individuals and families who face homelessness in our state. This strategic plan establishes statewide goals and benchmarks on which to measure progress toward these goals. The mission is to work together to make homelessness in Utah rare, brief and non-recurring. Read more

State of Utah Annual Report on Homelessness 2019

Utah is committed to using data to evaluate and inform efforts to make homelessness rare, brief and non-recurrent in the state. MAKING HOMELESSNESS RARE:

- The overall number of Utahns experiencing homelessness has largely remained stable.

- The 2019 Point-in-Time (PIT) count showed a decrease of 2.7 percent in the number of people counted as literally homeless situations on a single night in 2019.

- Comparing the PIT to the most recent Read more

Housing Cost Burden and Rental Assistance for Senior Households

Senior households face an increasing risk of housing affordability. Due to the aging of the baby boom generation and rapidly rising housing prices the number of cost-burdened senior households has increased significantly in recent years. Cost-burdened senior households, those spending more than 30 percent of their incomes on housing, totaled nearly 72,000 households in Utah in 2019. One in four senior households in Utah are cost-burdened and one in eight are severely cost burdened, those spending more than 50 percent of their incomes on housing. By 2025 the number of severely cost burdened senior households is projected to increase by over 8,900 households. To help inform the policy discussions for senior housing, this technical memorandum provides detailed cost-burdened data and enumerates housing assistance programs for Utah’s senior households. Read more

Can Medicaid Expansion Prevent Housing Evictions?

Evictions are increasingly recognized as a serious concern facing low-income households. This study evaluated whether expansions of Medicaid can prevent evictions from occurring. We examined data from a privately licensed database of eviction records in fourteen states (286 counties) and used a difference-in-differences research design to compare rates of eviction before and after California’s early Medicaid expansion (51 counties). Read more

Latest Demographics Publications

The Gardner Policy Institute provides demographic decision support to the Utah State Legislature and Office of the Governor. We produce population estimates and projections, as well as applied demographic research focused on Utah. We represent the state in work with the Census Bureau, including the State Data Center Program and Federal State Cooperatives for Population Estimates and Projections. We work with the Census Bureau in production, distribution, and analysis of their product.

Out of Reach Report 2019

Each year the National Low Income Housing Coalition publishes the "Out of Reach Report". Out of Reach documents the gap between renters’ wages and the cost of rental housing. The report’s Housing Wage is the hourly wage a full-time worker must earn to afford a modest rental home without spending more than 30% of his or her income on housing costs. It is based on HUD’s Fair Market Rent (FMR), which is an estimate of what a family moving today can expect to pay for a modest rental home in the area.

The 2019 Gap: The Affordable Housing Gap Analysis

Each year, NLIHC examines the American Community Survey (ACS) to determine the availability of rental homes affordable to extremely low-income households – those with incomes at or below the poverty line or 30% of the area median income (AMI), whichever is greater - and other income groups. The annual report provides a picture for the nation, each state plus the District of Columbia (DC), and the largest metropolitan areas.

View the 2019 Utah Housing Profile.

State of Utah Affordable Housing Plan 2018

The State of Utah supports evidence-based policies and practices that further fair and affordable housing in our communities. Research has consistently shown that decent affordable housing serves a vital stabilizing function for families with modest incomes. It has also shown that decent affordable housing improves the overall health, safety and welfare of our communities while reducing crime and poverty. Low-income households are more self-sufficient, and less dependent upon public assistance when they can afford decent housing. Statewide Affordable Housing Profiles 2018

Comprehensive Report on Homelessness - State of Utah 2018

The State of Utah Department of Workforce Services, Housing and Community Development Division, and its Community Services Office are pleased to present the 2016 Comprehensive Report on Homelessness in Utah. As in previous years, the intent of this report is to inform interested parties as to the state of homelessness in Utah. This report includes homeless data organized in geographic areas and information on best practices and homeless system initiatives. View the 2017 and the 2016 reports.

Housing Prices and the Threat to Affordability

What is the outlook for housing prices in Utah? Housing prices in Utah will continue to increase at rates well above the national average due to relatively high rates of demographic and economic growth, but the threat to affordability from rising prices may be secondary to increasing interest rates, which could significantly reduce housing affordability and home-ownership opportunities for a large share of Utah households.

Olene Walker Housing Loan Fund 2018 Report

Utah's Approach to Homelessness August 2018

Analysis of Affordable Housing for Low-Income Renters by Municipality

Statewide Affordable Housing Profiles 2018

State of Utah Affordable Housing Assessment 2017

Over the last decade its resilient economy has grown at an unprecedented rate. With more and better employment opportunities, its population has also seen steady growth. When preceded by adequate planning and community development, growth can be a positive sign of economic prosperity. However, Utah’s growth has not been without its pains. As we’ve seen over the last few years, growth is related directly to the state’s increasing demand for affordable housing. With an already scarce supply of housing—and a slow rate of housing production—rising demand has driven up the cost of all forms of housing. This assessment exams the need for affordable housing across the state and how this need disproportionately impacts specific populations or geographical areas.

Bussed Out

How America Moves its homeless - Each year, US Cities give thousands of homeless people one-way bus tickets out of town. an 18-month nationwide investigation by the Guardian reveals, for the first time, what really happens at journey's end.

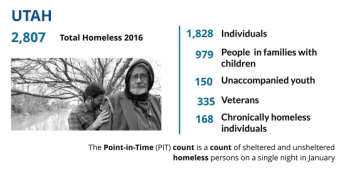

2016 Point-in-Time HUD Report to Congress (November 2016)

On a single night in 2016, 549,928 people were experiencing homelessness in the United States. A majority (68%) was staying in emergency shelters, transitional housing programs, or safe havens, and 32 percent were in unsheltered locations. The number of veterans experiencing homelessness increased in seven states between 2009 and 2016. The largest absolute increases were in Hawaii (171 more veterans), Utah (169) South Carolina (109), and Oregon (64). The largest percentage increases were in Utah (102%), Vermont (80%), Hawaii (34%), and Maine (19%). Read the full report

Report on the Economic Well-Being of U.S. Households in 2016

In order to monitor the financial and economic status of American consumers, the Federal Reserve Board conducted the third annual Survey of Household Economics and Decision making in October and November 2015. This survey provides insights into the well-being of households and consumers, and provides important information about how individuals and their families are faring in the economy. Topics examined in the survey include the overall well being of individual consumers, income and savings behaviors, economic preparedness, access to banking and credit, housing decisions, car purchases and auto lending, education and human capital, student loans, and retirement planning.

Salt Lake County Homeless Services: Challenges and Options 2016

The Kem C. Gardner Policy Institute has prepared this policy brief on homeless housing services at the request of Salt Lake County. This brief examines the feasibility of alternative initiatives—those that could be developed as new programs or achieved through the realignment of existing resources— that Salt Lake County may consider as it works to address some of the root challenges and systemic gaps within the homeless housing and services system.

The Economic Impact of Affordable Housing Programs in Utah - 2012

This study was undertaken by James Wood at the request of the Utah Housing Coalition. The purpose of this study was to estimate the economic impact generated by affordable housing programs in 2012 on Utah’s employment, earnings and tax revenues.

Manufactured Homeowners Rights and Responsibilities in Utah

Ley de Residencia Móvil

A look at manufactured homeowners' legal rights and the creation of the Helpline in 2015.

Utah Foundation's Research on Housing

Utah Foundation’s mission is to produce objective, thorough and well-reasoned research and analysis that promotes the effective use of public resources, a thriving economy, a well-prepared workforce and a high quality of life for Utahns. Utah Foundation seeks to help decision-makers and citizens understand and address complex issues. Utah Foundation also offers constructive guidance to improve governmental policies, programs and structures. Utah Foundation is an independent, nonpartisan, nonprofit research organization.